Farm Equipment, Motor Vehicle & Machinery Finance

Understanding Commercial Assets Finance

Commercial assets finance encompasses a range of financial products and services designed to facilitate the acquisition of essential assets for business operations. These assets can include machinery, vehicles, equipment, technology, and other tangible items necessary for driving growth and productivity. Unlike traditional methods of purchasing assets outright, commercial asset finance offers businesses the flexibility to acquire these assets through structured financing arrangements, thereby conserving capital and preserving liquidity.

ENQUIRE NOWTypes of Assets Financed

Commercial assets finance caters to diverse industry needs, covering a broad spectrum of assets essential for different business sectors. Some common types of assets financed through commercial assets finance include:

1. Motor Vehicles and Road Vehicles

From small business motor vehicles to utility trucks, commercial assets finance provides funding solutions for acquiring and maintaining a fleet of vehicles essential for transportation, logistics, and service delivery.

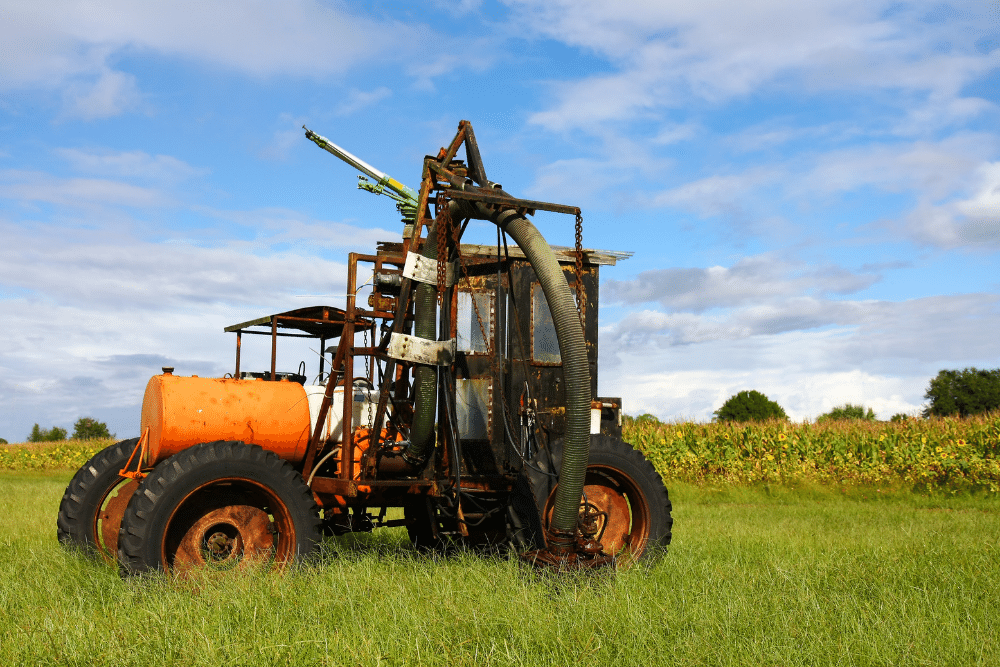

2. Farm Machinery

In the agricultural sector, commercial asset finance plays a pivotal role in financing vital equipment such as tractors, specialized farming machinery, and irrigation systems, enabling farmers to enhance productivity and efficiency.

3. Agricultural Equipment

Farm bikes, All-Terrain Vehicles (ATVs), and spray equipment are integral to modern agricultural practices. Commercial assets finance offers tailored funding options for acquiring and upgrading these essential assets, empowering farmers to stay competitive in a rapidly evolving industry.

4. Livestock Handling Equipment

Livestock handling equipment, including handling chutes, pens, and scales, is essential for efficient livestock management. Commercial assets finance provides farmers with the means to invest in high-quality equipment that streamlines operations and ensures the welfare of their animals.

5. Specialized Commercial Equipment

In industries such as construction, mining, and manufacturing, specialized equipment such as excavators, bulldozers, and industry-specific machinery are indispensable for carrying out complex tasks. Commercial assets finance offers customized financing solutions to help businesses acquire, upgrade, or replace this critical equipment, thereby enhancing operational efficiency and competitiveness.

To complement our mortgage services, we have broadened our services to include the provision of commercial assets finance for the following:

- Small business motor vehicle, utility, trucks and other road vehicles

- Farm machinery: tractors, specialised cropping and farming machinery

- Farm bikes, All Terrain Vehicles, Spray Equipment

- Livestock handling equipment

- Specialised commercial equipment: excavators, bulldozers and industry specific mahinery

Benefits of Commercial Asset Finance

The adoption of commercial asset finance offers several benefits for businesses across various sectors:

1. Preservation of Capital

By opting for commercial asset finance, businesses can conserve their capital reserves for other strategic initiatives such as expansion, innovation, or working capital needs. This preserves liquidity and enhances financial flexibility, enabling companies to seize growth opportunities as they arise.

2. Improved Cash Flow Management

Structured repayment schedules associated with commercial asset finance allow businesses to spread the cost of asset acquisition over time, aligning expenses with revenue generation. This facilitates better cash flow management and mitigates the impact of large, upfront capital outlays on the company’s financial health.

3. Access to State-of-the-Art Equipment

Commercial asset finance enables businesses to access the latest and most advanced equipment and technology without the need for substantial upfront investment. This ensures that companies remain competitive and can leverage cutting-edge tools to enhance productivity, quality, and innovation.

4. Flexible Financing Options

Commercial asset finance offers flexibility in terms of financing structures, repayment terms, and end-of-term options. Whether businesses prefer lease arrangements, hire purchase agreements, or asset-based lending solutions, there are tailored financing options available to suit their specific needs and circumstances.

5. Tax Benefits

Certain commercial asset finance arrangements may offer tax benefits such as depreciation allowances, interest deductions, and tax credits, which can result in significant savings for businesses. By structuring financing agreements strategically, companies can optimize their tax position while acquiring essential assets for their operations.

Considerations for Businesses

While commercial asset finance offers numerous advantages, businesses should carefully consider several factors before committing to a financing arrangement:

1. Financial Viability

Businesses should assess their financial position, cash flow projections, and ability to service debt obligations before entering into a commercial asset finance agreement. Conducting a thorough financial analysis can help determine the affordability and feasibility of the proposed financing arrangement.

2. Asset Lifecycle and Depreciation

It’s essential to evaluate the expected lifecycle and depreciation of the asset being financed. Understanding the asset’s residual value at the end of the financing term can help businesses determine the most appropriate financing structure and repayment schedule.

3. Interest Rates and Fees

Comparing interest rates, fees, and charges associated with different commercial asset finance providers is crucial for securing a cost-effective financing solution. Businesses should carefully review the terms and conditions of the financing agreement to ensure transparency and minimize the total cost of borrowing.

4. Asset Maintenance and Insurance

Businesses must factor in ongoing maintenance costs and insurance premiums associated with the financed asset. Maintaining the asset in optimal condition is essential for maximizing its operational lifespan and preserving its value.

5. Regulatory Compliance

Businesses should ensure compliance with regulatory requirements and industry standards when acquiring and financing assets. This includes adhering to legal obligations related to asset ownership, registration, licensing, and environmental regulations.

Conclusion

Commercial asset finance offers businesses a flexible and efficient means of acquiring essential assets needed for sustained growth and competitiveness. Whether it’s upgrading machinery, expanding fleets, or investing in cutting-edge technology, businesses can leverage tailored financing solutions to meet their specific needs and objectives. By carefully evaluating the benefits, considerations, and available options, businesses can make informed decisions that drive success and propel them towards their strategic goals.

For expert guidance and personalized commercial asset finance solutions, contact Alison today. Let us help you navigate the complexities of asset financing and unlock opportunities for growth and prosperity.