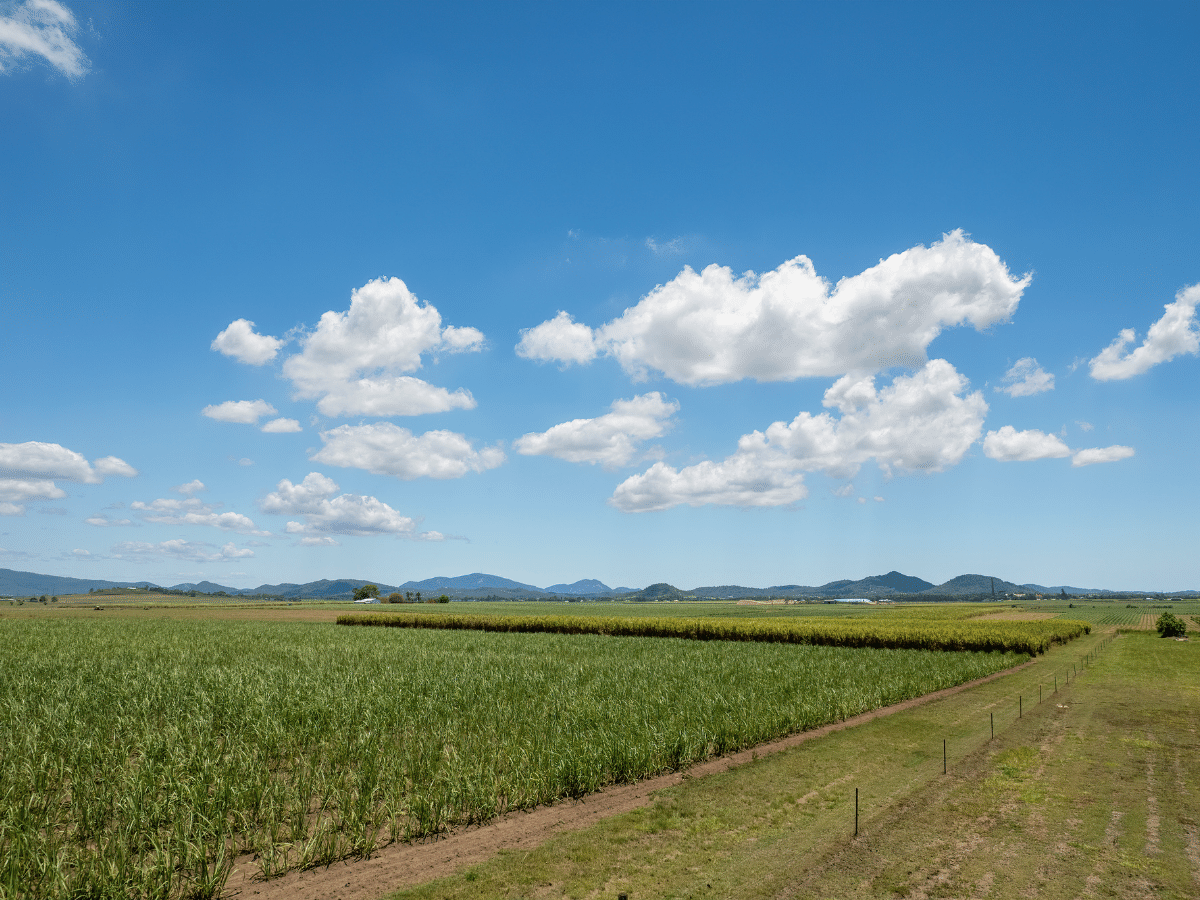

In the sprawling expanse of rural landscapes, the promise of wide-open spaces and untapped potential beckons many individuals and families. Whether it’s for farming, ranching, or simply the desire for a quieter, more serene lifestyle, owning acreage is a dream for many. However, turning this dream into reality often requires financial assistance beyond traditional mortgages. This is where acreage loans come into play, offering tailored solutions for purchasing and developing rural land.

Understanding Acreage Loans

Acreage loans, also known as rural property loans or land loans, are specialized financial products designed to facilitate the purchase or development of large parcels of land, typically in rural areas. These loans cater to individuals or businesses looking to acquire land for agricultural purposes, recreational use, or even residential purposes in rural settings.

At Rivendell Rural Finance, we specialize in providing comprehensive financial solutions for rural properties, including acreage loans tailored to the unique needs of our clients. Our expertise lies in understanding the intricacies of rural land transactions and crafting loan packages that align with our clients’ goals and financial capabilities.

The Importance of Specialized Financing

Acquiring rural land differs significantly from purchasing a traditional residential property. Factors such as land size, zoning regulations, environmental considerations, and agricultural potential all play crucial roles in determining the feasibility and value of the investment. Traditional lenders may be hesitant to finance acreage purchases due to the perceived higher risk and lack of comparable properties for valuation.

This is where specialized lenders like Rivendell Rural Finance shine. With a deep understanding of rural markets and a network of industry connections, we can offer financing options tailored to the unique characteristics of rural properties. Whether you’re purchasing farmland, a recreational retreat, or a rural homestead, we can structure a loan that meets your needs while mitigating risk.

Types of Acreage Loans

Acreage loans come in various forms, each suited to different purposes and borrower profiles. Some common types of acreage loans include:

- Land Purchase Loans: These loans are used to finance the acquisition of rural land for various purposes, including agriculture, recreation, or residential development.

- Farm Loans: Specifically designed for agricultural operations, farm loans can finance the purchase of farmland, equipment, livestock, and other farm-related expenses.

- Rural Home Loans: For those looking to build a primary residence in a rural area, rural home loans offer financing for both land acquisition and home construction.

- Land Development Loans: If you’re looking to develop raw land for residential or commercial purposes, land development loans provide funding for infrastructure development, such as roads, utilities, and site preparation.

- Refinancing: Existing landowners may benefit from refinancing their acreage loans to secure better terms, lower interest rates, or access equity for improvements or other investments.

The Acreage Loan Process

Securing an acreage loan involves several steps, from initial consultation to loan approval and settlement. At Rivendell Rural Finance, we guide our clients through each stage of the process, ensuring a seamless and transparent experience. Here’s an overview of what to expect:

- Consultation: We begin by discussing your financial objectives, property requirements, and loan preferences. This helps us understand your needs and tailor a loan package that aligns with your goals.

- Pre-Approval: Once we have a clear understanding of your requirements, we’ll assess your financial situation and provide a pre-approval letter indicating the loan amount you qualify for.

- Property Evaluation: Before finalizing the loan, we’ll conduct a thorough evaluation of the property to assess its value, condition, and suitability for your intended use.

- Loan Approval: Once the property evaluation is complete and all necessary documentation is provided, we’ll submit your application for loan approval.

- Settlement: Upon approval, we’ll work with all parties involved to finalize the loan agreement and facilitate the settlement process.

Benefits of Acreage Loans

Acreage loans offer numerous benefits for aspiring rural landowners, including:

- Flexible Terms: Acreage loans can be tailored to accommodate the unique needs and financial circumstances of borrowers, with flexible repayment terms and interest rates.

- Specialized Expertise: Working with a lender that specializes in rural finance ensures access to industry expertise and personalized guidance throughout the loan process.

- Customized Solutions: Whether you’re purchasing farmland, a recreational property, or a rural homestead, acreage loans can be customized to meet your specific requirements.

- Opportunity for Growth: Acreage loans provide the financial means to acquire and develop rural land, unlocking the potential for agricultural production, recreational activities, or residential living.

Conclusion

Owning acreage in rural areas offers countless opportunities for growth, adventure, and a simpler way of life. However, realizing this dream often requires specialized financing solutions tailored to the unique characteristics of rural properties. Acreage loans, offered by specialized lenders like Rivendell Rural Finance, provide the financial means to turn your rural land aspirations into reality. With personalized guidance, flexible terms, and a deep understanding of rural markets, we’re here to help you unlock the potential of rural landownership. Contact us today to learn more about our acreage loan options and start your journey towards rural property ownership.